Key Findings

This investigation examined whether RealPage’s widely used “Revenue Management” and pricing algorithms have a significant impact on rental housing costs. ProPublica’s initial allegations about RealPage’s software—known under brands like YieldStar—sparked concerns that landlords might engage in tacit price-fixing through an algorithm rather than negotiating rents independently. RealPage denies such claims. Motivated by these debates, we sought to (1) quantify how much more, if any, RealPage-managed properties charge relative to non-users, and (2) determine whether RealPage’s 2017 acquisition of its largest competitor, Lease Rent Options (LRO), generated additional supra-competitive rent increases.

Thus, this page explores the key patterns in rent pricing using updated difference-in-differences methods and non-causal models. Rather than asserting definitive collusion, our analyses highlight statistically significant rent impacts associated with RealPage usage. Management Named in Lawsuits Against RealPage are grouped for comparison throughout.

This chart compares rent levels by metro, grouped by city.

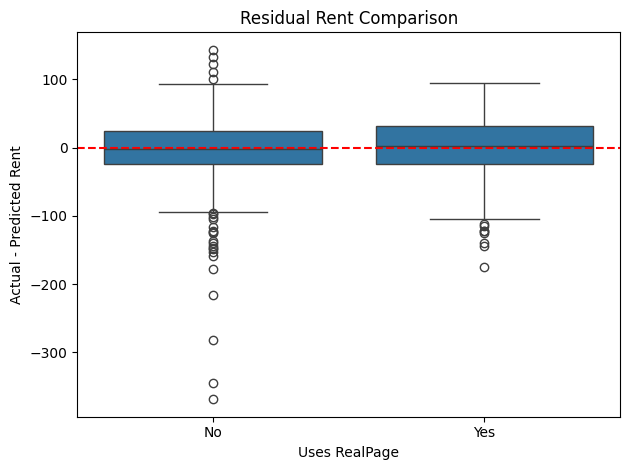

Machine Learning Models

The following visualizations provide insights into the machine learning models' performances and feature importance. These visualizations help in understanding the models' predictions and the significance of different features in the dataset.

Predicting the Usage of RealPage

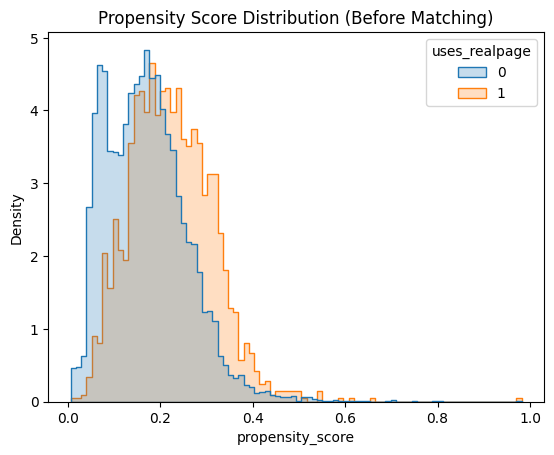

We first developed a machine learning model to predict whether a property uses RealPage based on features like location (CBSA), size, age, unit count, and market conditions. After cleaning and preparing the data, we used logistic regression to estimate the likelihood of RealPage usage. This model helps identify patterns across properties and supports deeper analysis into how RealPage's software might influence rental pricing.

Propensity Score & Machine Learning for Rental Pricing

This analysis explores how RealPage's pricing software may impact rents in the multifamily housing market. Researchers compiled data on over 42,000 U.S. properties, identifying ~5,000 RealPage users through public legal records. Due to inconsistent property names and addresses, fuzzy matching techniques—such as text normalization, Levenshtein distance, and address scoring—were used to link records across datasets.

After cleaning, key features like unit count, square footage, age, occupancy, and market competitiveness were selected. Locations were represented using Core-Based Statistical Areas (CBSAs), which were one-hot encoded to allow the model to recognize regions without assuming relationships between them. These were combined with numeric features to train the model.

A logistic regression model estimated the likelihood (propensity score) that a property uses RealPage. Each RealPage property was then matched to a similar non-user to reduce bias, simulating a randomized control trial. Results showed RealPage properties charge $0.27 more per square foot on average, suggesting a meaningful pricing impact.

Simulating Predicted Prices

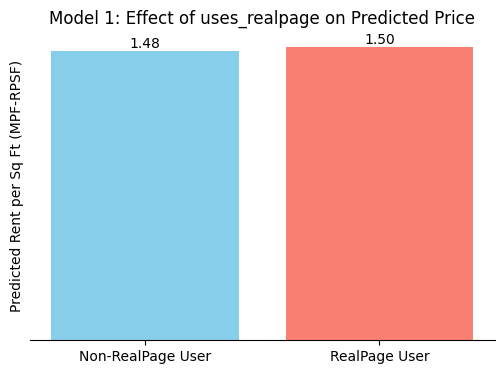

We simulated predicted price per square foot (MPF-RPSF) under two scenarios:

-

Varying

uses_realpage:

A representative property is simulated with most features held constant, while toggling theuses_realpageflag between 0 and 1 to isolate RealPage's effect on price. -

Varying

market_shareanduses_realpage:

Simulated properties with differentmarket_sharevalues for both RealPage and non-RealPage users. This shows how pricing responds as RealPage's presence increases in a given CBSA.

These simulations validate the models and provide intuitive visual insights into RealPage's pricing influence.

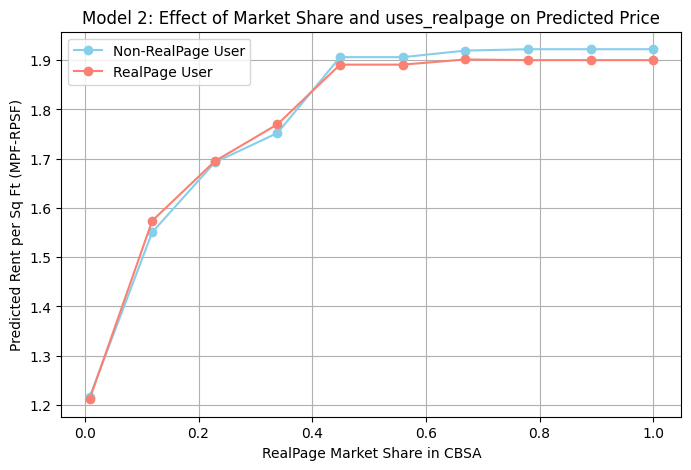

Market Share & RealPage Usage Interaction

The updated model adds RealPage's market share within each CBSA to examine its interaction with pricing outcomes.

Market Share Calculation:

RealPage Market Share = (Number of RealPage Properties) / (Total Properties in CBSA)

This variable is included alongside other property-level features, along with an interaction term between

uses_realpage and market_share. This allows us to test whether RealPage's pricing impact

grows with its local dominance.

Simulations illustrate predicted price per square foot across a range of market share values for both user types, highlighting how RealPage saturation may amplify pricing effects.

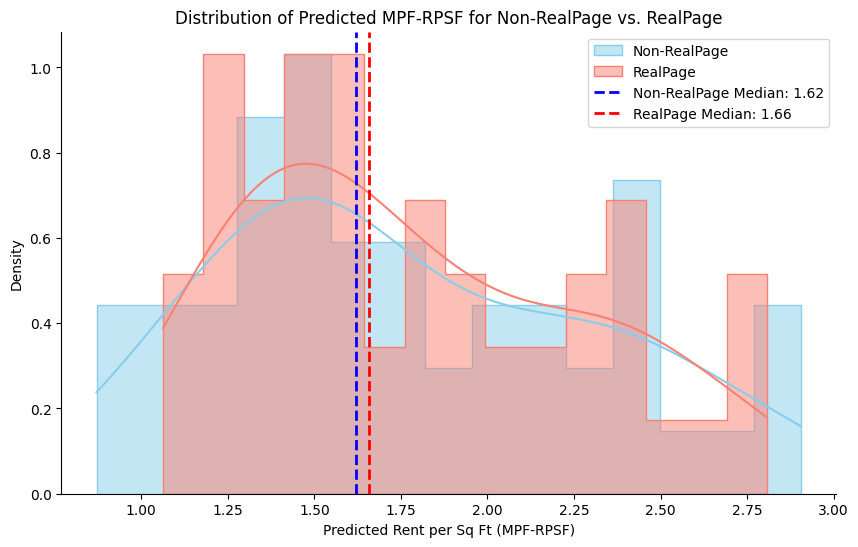

Simulating Distributions of RSPF for RealPage Users vs Non-RealPage Users

In this section, we perform simulations to illustrate how the distributions of predicted rent per square foot (RSPF) differ between RealPage and non-RealPage users using the FFNN model.

-

Variation in RSPF with

uses_realpageFlag:

We generate simulated data points for a representative property by holding most features constant while switching theuses_realpageflag between 0 and 1. This will help us see the effect of being a RealPage user on the predicted price. -

Varying

market_shareanduses_realpage:

The second simulation shows how the predicted MPF-RPSF changes as RealPage’s market share in the CBSA changes. We generate two sets of simulated properties (one for non-RealPage users and one for RealPage users) while varying themarket_sharefeature over a range of values. The resulting plots will show the relationship between market share and predicted price for both groups.

Our goal is to demonstrate that the distributions of the predictions differ significantly as the value of uses_realpage changes.

One-sided Mann-Whitney U test (RealPage > Non-RealPage):

U-statistic: 1270.0000

p-value: 0.4465

Result: The test did not detect a statistically significant difference (p ≥ 0.05).

Click on the visualizations below to view them in full size.

It is Unclear Whether this Rent Impact is Due to Price Coordination

Our predictive models suggest that RealPage usage can predict higher rents. However, can we test whether this correlation is actually *because of* effects which are similar to price-fixing, and not other factors like efficiency?

In December 2017, RealPage completed an acquisition of Lease Rent Options (LRO), their primary competitor in the market for rental pricing algorithms. Did this acquisition lead to higher rent in the housing market? If the answer is yes, then this may be because of price-coordinating effects, because no landlords actually merged - the only merger was between providers for price algorithms. Market power would only change if landlords using one of RealPage's products (post-merger) were coordinating via the algorithms.

However, we do not see this effect; therefore, our data does not prove whether or not price coordination is the root cause of RealPage's rent impact.

ARIMA Forecasting to Adjust for COVID Impact

The COVID pandemic of 2020 had a significant effect on the housing market which varied across cities and time. To test the effect of a 2017 merger, we start by adjusting for the effect of COVID in 2020 and beyond. We trained an ARIMA forecasting model from December 2017 to December 2019, then use this to predict three years of housing market data without the effect of COVID.

Zillow Index and COVID Adjustment (2015 - 2022)

Divide Cities into Treatment and Control Groups

Next, we need to select a treatment group and a control group. If this merger has an effect, it would have the highest effect on cities with both a high RealPage penetration rate and a high share gain from the merger (and the lowest effect on cities with low penetration rates and share gains).

We estimate RealPage's share of multifamily rental units based on their own disclosed share of *all* rental units for 20 select cities in May 2023, the count of total units according to the 2023 American Community Survey, and the share of units which are multifamily from the same survey. We select the cities with the highest share (Atlanta, Dallas, Phoenix, Denver, Tampa, and Washington DC) as the treatment group, and the cities with the lowest share (Minneapolis, San Diego, Miami, San Francisco, Chicago, Detroit, Los Angeles, and New York) as the control group.

"RealPage's Multifamily Penetration Rate by City (May 2023)

Compare Merger Effects on Treatment and Control Cities

For each of the six treatment cities, we use a machine learning approach called the "Synthetic Control" method to predict the treatment city's pre-merger rent level using only the control cities' rent levels. We make this prediction model as accurate as possible using only pre-merger data, then use that model to predict the post-merger rent levels.

In essence, the Synthetic Control is a prediction of what a city's rent *would* look like if the combined market share was much lower there. If a city's rent is much higher than its Synthetic Control predicted level, this suggests that the 2017 RealPage-LRO merger may be causing higher rent. Conversely, if the city's rent is much lower than its Synthetic Control predicted level, this suggests that the merger may be causing lower rent.

However, differences are small and generally inconsistent across cities. In Phoenix, this method predicts higher rents, but in Atlanta and Dallas, this method predicts lower rents. In the remaining three cities, there is no obvious difference. Furthermore, divergence for some cities begins in 2020, suggesting that this may be due to imperfections in the COVID adjustment. Because of this inconsistency, we cannot conclusively say whether RealPage's rent impact is a result of price-coordination.

High-Share Cities and their Synthetic Controls (2015 - 2022)

Conclusion

Our research demonstrates a positive association between RealPage software usage and higher rents—approximately 0.23 dollars more per square foot each month. On the other hand, the post-merger analyses do not provide robust or uniform evidence that RealPage’s acquisition of LRO caused additional rent hikes attributable to enhanced algorithmic collusion. This suggests that while algorithmic pricing may be boosting rents where it is adopted, the merger itself does not appear to have notably intensified that effect on a widespread basis. It remains possible that algorithmic pricing could enable supra-competitive coordination even without a merger, as some economic models suggest. Likewise, RealPage’s own position is that these tools improve operational efficiency for landlords in ways that do not involve collusion. Ultimately, further research is needed to isolate which features of algorithmic pricing might genuinely threaten competition.

Policy Implications and Recommendations

- Increased Transparency: Policymakers could require property management firms or software developers to disclose the scope and nature of their algorithmic pricing use. Such disclosures help ensure that public agencies, renters, and watchdogs can monitor for potential abusive behaviors.

- Ongoing Oversight and Market Monitoring: Housing regulators and antitrust authorities should track market penetration rates, particularly in localities that exceed certain thresholds for RealPage or similar software usage, to evaluate potential impacts on competition.

- Further Regulation of Pricing Algorithms: Legislators may consider rules that regulate how competitor data is aggregated or shared to ensure that these tools do not inadvertently facilitate tacit collusion.

- Encourage Independent Research: Supporting academic or government-sponsored studies can expand access to more granular data (e.g., property-level historical rents, occupancy, or landlord usage patterns) to clarify whether algorithm-driven rent increases harm competition or reflect efficient market pricing.

.png)

.png)