Is Algorithmic Pricing Raising Your Rent?

A Data-Driven Investigation

RealPage's software lets landlords share secret pricing data, coordinating rent hikes instead of competing for tenants. The result? Higher rents, fewer concessions, and no real choice for renters.

Landlords aren't setting prices—an algorithm is. RealPage collects and analyzes private rent data from competitors, then recommends price hikes landlords follow almost automatically. This isn't competition—it's algorithmic price-fixing.

This isn't just bad for renters—it's bad for the market. RealPage controls 80% of the apartment pricing software industry, creating a monopoly that locks landlords in and locks renters out of fair pricing.

When landlords collude, renters lose. Lawsuits are underway, but millions of renters have already paid the price. Housing should be a competitive market—not a rigged game.

Or scroll down to learn how price coordination and algorithmic collusion work.

Scroll down to learn about the major factors that determine rent prices.

What factors into rent?

and how does RealPage compare?

Two major factors affect rent prices: the market and the condition of the property. We use the year built and metropolitation area to compare RealPage-managed properties to the rest of the market.

Scroll down to understand who RealPage serves and in what markets.

Contextualizing RealPage

Who does RealPage serve and how did the LRO merger affect prices?

Realpage isn't serving mom and pop landlords: they court large property management companies. In Spring 2017, RealPage acquired their main rival, LRO. This merger allowed RealPage to collect more data and increase their market share.

Scroll down to explore how we model RealPage's Effects

Modeling RealPage's effect

How can we predicting and simulate RealPage's effect on the housing market?

Propensity Model

Overview: This model helps us guess whether a property is likely to use RealPage by looking at its obvious features. The idea is to find properties that are very similar, except for the use of RealPage, so we can fairly compare their rents.

Methodology: Data was carefully cleaned by removing missing details, cutting out sparse features, and tackling issues with overlapping or redundant information. We focused on straightforward factors like the age of the property, how many units it has, average size, number of floors, and other identifiers like area codes and building types.

Then, we used a logistic regression to calculate a score – the propensity score – which indicates how likely a property is to use RealPage. Properties were paired up (one using RealPage and one not) based on these scores. This lets us isolate the effect of RealPage by comparing similar properties directly.

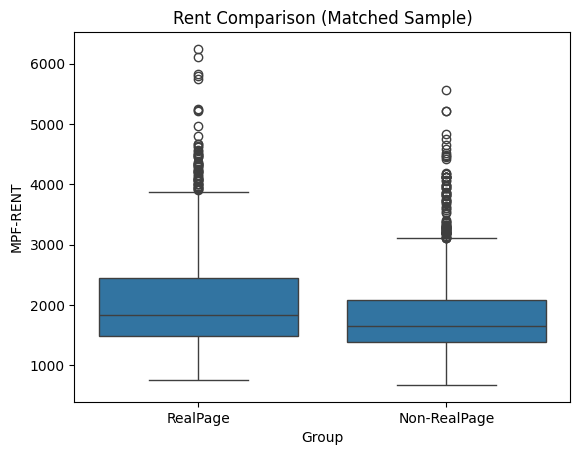

Initial Conclusions: We found around one–thousand eight–hundred and sixty pairs, and properties flagged as using RealPage generally have higher rents than those that don’t. This matching helps show a clearer link between RealPage usage and rent increases.

Rent–Prediction Simulation Model

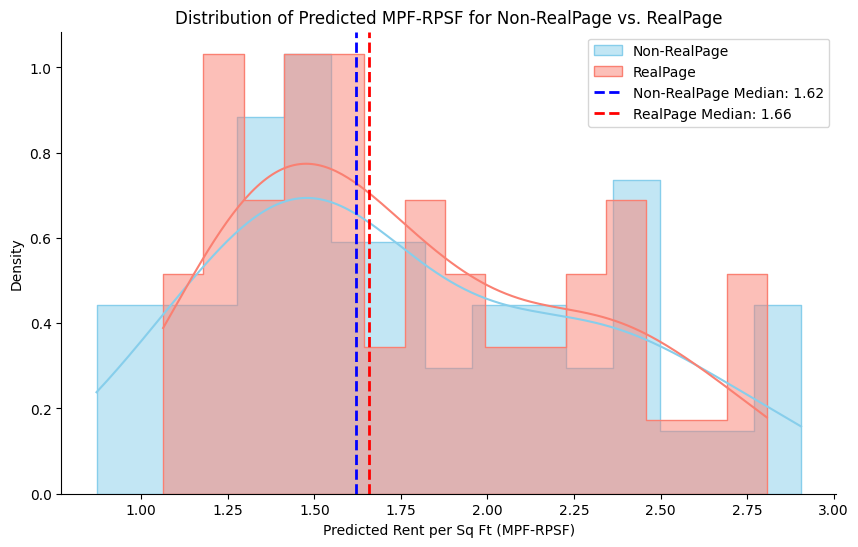

Overview: This model is part of our broader rent–prediction toolkit. It shows how flipping the RealPage usage flag changes the predicted rent per square foot, giving us a clear idea of its influence on pricing.

Methodology: We combined detailed property data with broader market trends, pulling in important figures like market reach and average unit size. After cleaning the data, we honed in on the factors that really affect rent.

Using advanced methods like random forest, gradient boosting, and a feed–forward neural network, we predicted rent per square foot. The trick was to run the simulation twice – once with the RealPage flag turned on and once with it off – to see how much of a difference it makes.

Initial Conclusions: The results were pretty consistent: turning on the RealPage flag led to a higher predicted rent per square foot. This suggests that, even when controlling for many factors, properties using RealPage tend to have higher rents. While it isn’t a direct proof of collusive behavior, it does point to a strong association with rent inflation.

Scroll down to review a summary of our key findings.

Key Findings and Policy Implications

Our investigation found a significant association between the use of RealPage’s pricing algorithms and higher rental costs. Properties utilizing RealPage software charged, on average, $0.23 more per square foot monthly compared to similar properties not using the software. However, an analysis of RealPage’s 2017 acquisition of competitor Lease Rent Options (LRO) found no consistent evidence that the merger directly increased rents through algorithmic collusion.

Key Findings:

- RealPage-managed properties consistently exhibit higher rent levels, suggesting algorithmic pricing may contribute to increased rental costs.

- Extensive analysis of the RealPage-LRO merger using advanced econometric techniques (Synthetic Control Method) found no conclusive evidence of increased rent due to algorithmic collusion following the merger.

- Rent impacts varied significantly by city, with Phoenix being the only consistent exception, showing notable rent increases post-merger.

Policy Implications and Recommendations:

- Transparency and Disclosure: Regulators should mandate clearer reporting from property management firms regarding their use of algorithmic pricing software to better understand its market impacts.

- Enhanced Oversight: Agencies should actively monitor and investigate markets with substantial algorithmic pricing penetration to ensure competitive fairness.

- Targeted Regulation: Consideration should be given to regulating the functionality and data usage of algorithmic pricing tools to prevent potential anti-competitive practices.

- Further Investigation: Additional comprehensive research is necessary to fully discern the competitive dynamics and consumer impacts associated with algorithmic pricing in rental housing markets.